Subscription fees are waived for prepaid accounts in months when you spend over $50,000 or more on your Profit debit cards.

-

Prepaid Card Account

(Per open card per month) Includes physical or virtual cards.

- Budgets

- Projects

-

Checking Accounts

No Min balance. No hidden fees. Free ACH transfers, deposit checks via mobile phone, control employee access to view and transfer funds.

- Invoicing Software

- Payment collection

- Automated Bookkeeping

- Accounting Software

- Financial Statements

-

Receipt Tracking

Cardholders can photograph and attach receipts to purchases within the Mobile App. Admins can then access and review them.

-

Dedicated Account Manager

Available M-F, 9am-5:30pm EST.

- Up to 10

- Up to 4

- Up to 4

- Up to 2

- Standard

- Up to 25

- Up to 8

- Up to 8

- Up to 5

- Standard

$69/mo

For small to medium sized businesses that are ready to scale through customization

- Up to 50

- Up to 12

- Up to 12

- Up to 10

- Custom

- Up to 100 (additional cards are $2 each)

- Up to 16

- Up to 16

- Up to 20

- Custom

Invoice Pricing

Create and send invoices at no extra charge. See below for pricing to accept credit/debit card payments

Standard Plan

2.89% + 30¢

* per successful card charge

Bundle & Save

Profit clients with active Prepaid Business Cards get discounts on accepting credit/debit card payments.

Prepaid Business Card Spend/mo

- $20k/mo

- $50k/mo

- $100k/mo

- $150k/mo

Discount Acceptance Rate

- 2.79% + 30¢ *

- 2.69% + 30¢ *

- 2.59% + 30¢ *

- 2.49% + 30¢ *

* per successful card charge

Learn More

Want to learn more about what we offer? We’re here to help you learn ways to maximize your business profit.

Contact SalesFeature Comparison

- Features

-

Traditional

Banks -

Accounting

Software -

Bookkeeper

-

Prepaid Business Cards

Prepaid Business Cards

-

Traditional Banks

-

Accounting Software

-

Bookkeeper

-

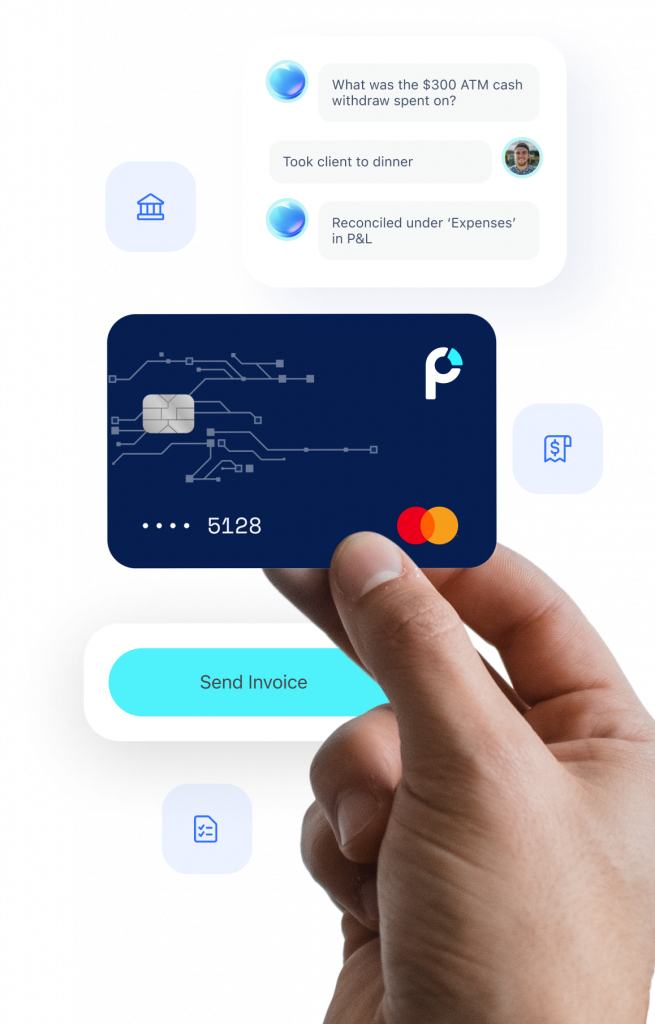

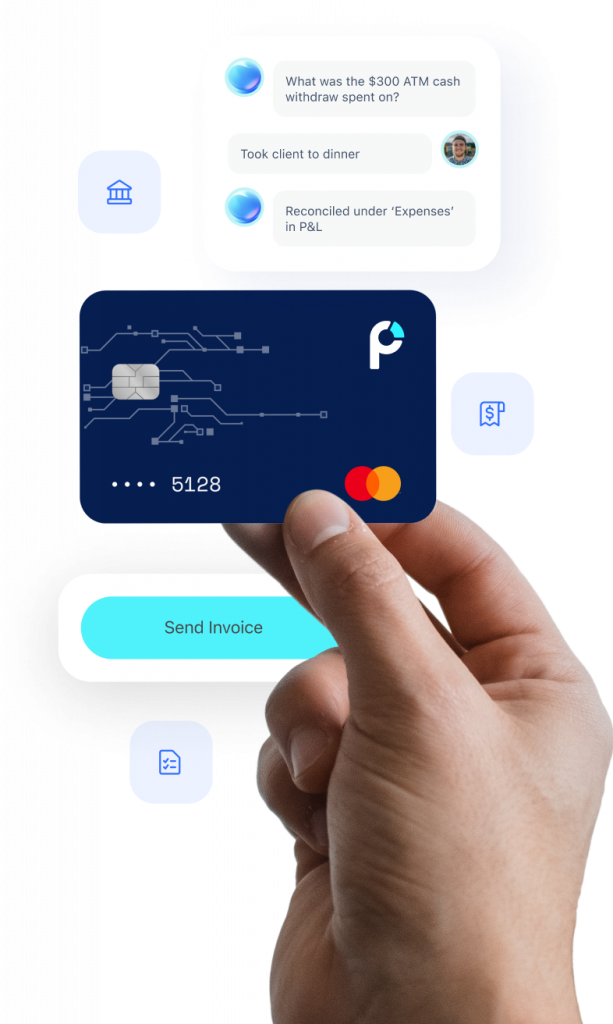

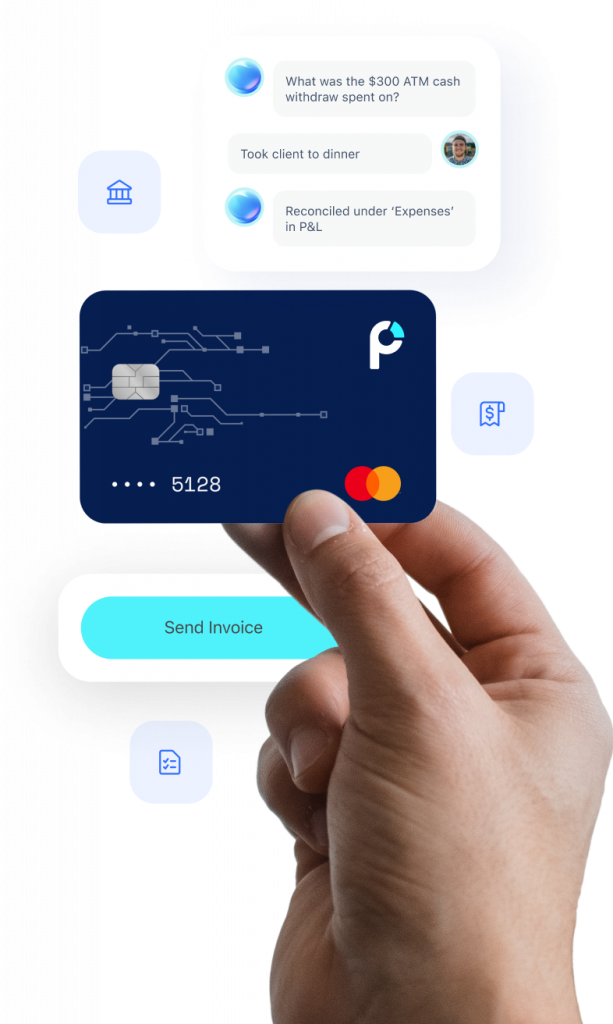

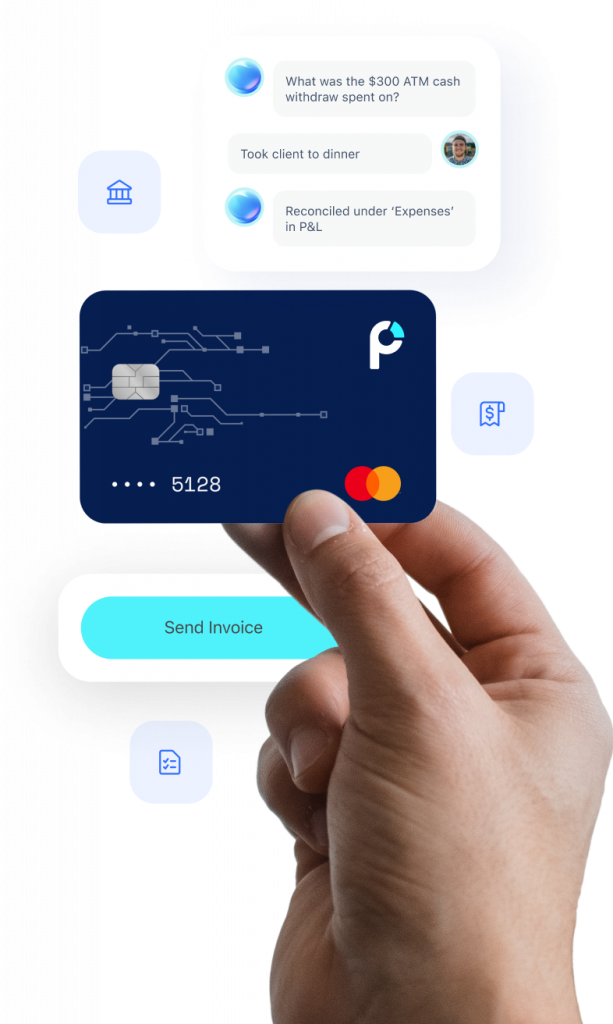

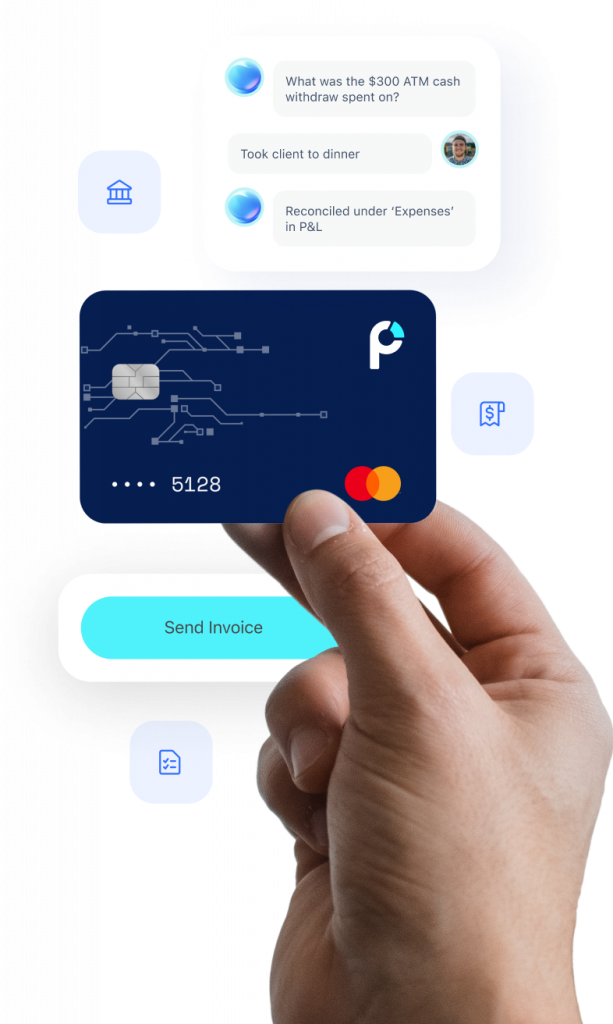

Learn MoreGive employees prepaid cards you control

Issue physical or virtual cards, view spend in real-time, set individual card limits, automatically track receipts.

Invoicing & Payments

Invoicing & Payments

-

Traditional Banks

-

Accounting Software

-

Bookkeeper

-

Learn MoreEasy invoicing and speedy payments

Create & send custom invoices. Offer flexible payment options with credit card, debit card and ACH.

Financial Management of Budgets & Projects

Financial Management of Budgets & Projects

-

Traditional Banks

-

Accounting Software

-

Bookkeeper

-

Learn MoreImprove revenue and profitability with a real-time review of projects and budgets.

Track profitability and expenses through controlled funding and comprehensive reporting that shows spend per project, cardholder, and merchant.

Free Accounting Software & Automated Bookkeeping

Free Accounting Software & Automated Bookkeeping

-

Traditional Banks

-

Accounting Software

-

Bookkeeper

-

Learn MoreBuilt-in accounting software plus Ires, our automated bookkeeper

Ires saves you time by reconciling all your PROFIT transactions and automatically generating P&L, Balance Sheet, and Cash Flow Statements

Business Banking

Business Banking

-

Traditional Banks

-

Accounting Software

-

Bookkeeper

-

Learn MoreModern business banking with no minimum balance and no hidden fees

Free ACH transfers, deposit checks via mobile phone, control employee access to view and transfer funds

“Profit shaves off so much time and is so convenient. It also tracks individually what every person is spending.”

Theresa McFaul Owner, Mai Vu Plumbing & Construction

It's time to maximize your business profits

Book A DemoIs PROFIT by Paymentus legit?

PROFIT by Paymentus is an All-in-One financial technology platform for small businesses. Bank accounts are FDIC insured up to $1 million and are provided by PROFIT by Paymentus’ partner bank Evolve Bank & Trust, member FDIC, founded in 1925. PROFIT by Paymentus is a division of Paymentus (Established in 2004).Paymentus is a leading provider of cloud-based bill payment technology and solutions serving more than 1,700 billers and financial institutions across North America. Our platform is used by tens of millions of consumers and businesses to complete hundreds of millions of payment transactions each year. Paymentus is a publicly traded company (PAY).

Is my credit affected when I apply for a PROFIT account?

No, we do not run your credit history, so it will NOT impact your credit score. On the application, you will be asked for your social security number and your company’s tax ID number (FEIN), but that’s simply for identity purposes. The government requires every bank in the US to verify the user’s identity before opening a bank account.

What type of companies can open a PROFIT account?

PROFIT accepts Corporations, LLCs/LLPs, and Associations that were incorporated in the U.S. only.

We are unable to support businesses related to:

Sole proprietor

Non-profits

Adult entertainment

Marijuana/Cannabis

Gambling

Crypto

Crowdfunding

Money Service

ATM businesses

What do I need to open an account with PROFIT?

Below are the three documents you will need:

- A picture of your valid driver’s license front & back.

- A picture or copy of your EIN Tax ID verification letter (may not apply to Sole Proprietors).

- A picture or copy of your company’s articles of incorporation

Click on the hyperlinks above to see how to obtain copies of the documents in case you misplaced them.

All applicants must have a mobile phone, Social Security number, and a U.S. address to complete the application.

The documents we require vary state by state depending on your entity. During the application, you will be asked to upload the necessary documents to apply for an account. If you operate under a business name that is not your own, you will be required to provide a copy of your Do Business As (DBA) documents.

All applicants must be at least 18 years old.

How long does it take to review my application?

1 min to 1 business day, depending on if further documentation or details are required. One of our team members will reach out to you if we need further details.